The Graduate “Tax” Guest Speaker Series brings today’s leading accounting professionals into the classroom to share their real world experiences with students at Cal Poly.

The Orfalea College of Business graduate “Tax” Guest Speaker Series provides accounting students with a unique platform from which to share questions and ideas with some of California’s top tax practitioners. Guest Speakers will be high-level professionals, including partners from top accounting firms, and boutique firm executives – many of whom work in Los Angeles, Silicon Valley, and the Bay Area.* The seminars cover an array of sophisticated tax topics ranging from partnership hedge fund allocations to reverse section 1031 exchanges. Accounting students interested in taxation are strongly encouraged to attend the seminars, which will be scheduled during normal class hours. Further information can be found in your class syllabus. This is the perfect opportunity to interact with tax professionals, learn more about complex concepts in tax, as well as identify prospective tax-related careers.

*Please be advised guest speaker availability, dates and topics are subject to change without notification

JIM BESIO

Jim is an Executive Director in Ernst & Young’s West Region state and local tax practice. He hasover 20 years of experience as a state and local tax consultant, and currently serves as theIndirect Tax Markets Leader for Ernst & Young’s San Jose Office. Since joining Ernst& Young in 1994, Jim has been involved in a variety of state tax projects including tax minimization, audit representation, FAS 109, tax due diligence, state tax refund reviews, tax credit studies, andbusiness re-location and re-structuring projects. Jim works with numerous clients including many listed in the Fortune 500, and serves a variety of diverse industries.

CHRIS BOUCHER

CHRIS BOUCHER

Chris is a partner at Apercen Partners LLC, a boutique tax consulting firm headquartered in the heart of Palo Alto. He provides thoughtful and proactive income tax, wealth transfer, and charitable planning strategies to ultra-high net worth clients. Chris specializes in advising individuals and families with GP interests in venture, private equity and hedge funds, as well as technology executives with substantial equity compensation. To best serve his clients, Chris collaborates with estate planning attorneys, investment professionals and other trusted advisors. Chris received his B.S. degree in Business Administration with a concentration in accounting from Cal Poly, San Luis Obispo in 2008.

BRIAN BYRNE

BRIAN BYRNE

Brian is a partner in the Ernst & Young’s San Jose office providing tax consulting and compliance services for over 24 years. Brian has extensive experience providing tax consultation with multinational clients and emerging growth companies on complex and technical tax accounting issues. Over the last 22 years, Brian has also defended, facilitated and negotiated examinations with the Internal Revenue Service, the Franchise Tax Board and various other state and international tax authorities.

LINDSAY K. CHAMINGS

Lindsay is a Managing Director in the Alternative Investment Fund practice at Andersen Tax. She has more than 11 years of experience ranging from financial services taxation, ASC 740, and international tax. Prior to joining Andersen Tax, Lindsay was a senior tax manager at KPMG and Rothstein Kass and worked with Big 4 firms in both London and San Francisco.

JAMES CODY

Jim is a Director in Estate and Trust Services at Harris myCFO, Inc. and is responsible for delivering comprehensive family office solutions to individuals and families of substantial wealth. He specializes in philanthropy, estate and trust planning and counsels clients on sophisticated tax saving, wealth preservation and wealth transfer strategies. He has more than 25 years of professional experience. Prior to joining Harris myCFO, Jim led the Estate and Trust practice group for a San Francisco area law firm, where he practiced law for over 17 years.

SCOTT COOPER

SCOTT COOPER

Scott is currently the CFO of WaveTec®. He has spent nearly his entire career in financial and accounting positions at high technology and medical device companies in Silicon Valley and Orange County. Prior to joining WaveTec®, he was Corporate Controller at IntraLase Corp. during a period of rapid growth from a private company through IPO to the ultimate sale of the company to Advanced Medical Optics. Scott has held several financial management positions and began his career in public accounting at KPMG. He is a Certified Public Accountant, holds a BS degree from California Polytechnic State University, San Luis Obispo and has an MBA from the University of Michigan.

CHRISTINA EDWALL

CHRISTINA EDWALL

Christina has ten years of public accounting experience and is currently a senior manager in the Silicon Valley office. During her time at Deloitte, Christina has provided tax services to a diverse client base including high technology, hospitality and consumer business clients. Christina spent two-years in the Washington National Tax practice, specializing in accounting for income taxes. Additionally, Christina taught accounting for income taxes in the San Jose State Masters of Taxation program in 2008 and 2009. Christina received her Bachelor of Science from California Polytechnic State University, San Luis Obispo and her Master in Taxation from the University of Denver. She is a licensed Certified Public Accountant in California and is a member of the American Institute of Certified Public Accountants. In addition, Christina serves on the Board for Moments of Happiness.

GEORGE FAMALETT

GEORGE FAMALETT

George is a Tax Partner in the NorCal tax practice of PricewaterhouseCoopers LLP. Current responsibilities include market leader for the Northern California State and Local Tax practice. As a member of the State and Local Tax Practice, he provides tax consulting services on an array of domestic tax issues to a wide range of technology, telecommunications, financial industry and consumer product clients.

ERINNE FURHRING

ERINNE FURHRING

Erinne Fuhring is an experienced Manager in PricewaterhouseCoopers LLP’s State and Local Tax Group in the San Francisco Bay Area market. She is responsible for assisting a broad range of clients in technology, retail, manufacturing, life sciences and financial industries. With over 7 years of experience in multistate tax consulting and compliance her main focus is assisting clients with income, franchise and sales/use tax matters related to mergers and acquisitions, business transactions, apportionment issues, compliance review, and state tax controversies. Erinne received her B.S. and M.S.T degrees from California Polytechnic University, San Luis Obispo.

RONALD GONG

RONALD GONG

Ron is a Managing Director in the Palo Alto office of Harris myCFO, leading an integrated team of wealth management professionals who serve clients throughout Silicon Valley and the US. Ron has over 25 years of tax experience helping affluent clients manage a broad range of personal wealth matters. Ron’s background with a Big 5 international accounting firm and over a decade at Harris myCFO allows him to combine his tax and extensive business knowledge to provide clients with a single comprehensive wealth management resource.

KYLE GOTCHER

KYLE GOTCHER

Kyle is a Manager at C&D llp and has a wide range of experience in tax preparation for individuals, businesses, and estates and trusts. With a focus on Accounting, Kyle graduated from California Polytechnic State University, San Luis Obispo with a BS in Business Administration. He started work at C&D llp in 2009 after completing his internship with them. Kyle has been a guest speaker on several occasions for real estate professionals throughout Santa Barbara County regarding short sales, foreclosures, and the related tax issues.

EMILY HALL

EMILY HALL

Emily is Managing Director in Commercial practice at Andersen Tax. She has over 9 years of experience in public accounting. Her practice area focuses on corporate federal and state tax compliance, consulting, and provision services for public and privately held clients. As part of the Commercial group, Emily focuses on helping clients coordinate corporate income tax planning and compliance. She also assists clients with income tax provision preparation and coordination with client’s financial statement auditors. Before joining Andersen Tax, Emily practiced with international professional services firms in San Francisco and the Silicon Valley.

JOSH HARBIN

JOSH HARBIN

Josh Harbin is a senior in Deloitte Tax’s national Research & Development and Government Incentives Group. Josh is experienced in managing complex R&D tax credit engagements, including examinations by the IRS. Josh primarily serves clients in the Silicon Valley and Pacific Northwest with a focus on the software, hardware, and life sciences industries. Josh is a California CPA, a member of the AICPA, and holds a Master’s of Science in Accounting Taxation from Cal Poly, San Luis Obispo.

ALEX HAYES

ALEX HAYES

Alex is a Tax Director in Deloitte’s Silicon Valley practice and has more than 18 years of delivering international tax services to both US and Non-US multinationals. Alex has worked in public accounting for the majority of his career, but also has industry experience, having served as the Senior Director of International Tax for KLA-Tencor Corporation, a $2 billion publicly-traded semiconductor manufacturing equipment company.

BRIAN HEISMAN

BRIAN HEISMAN

Manager , Global Structuring – Brian is a manager in PwC’s Global Structuring tax practice in Silicon Valley, CA, where he is focused on mergers and acquisitions, global integration and supply chain management, business divisions, cross-border reorganizations, attribute limitation and recovery analysis, liquidations, and redemptions. Brian has advised on numerous transactions providing both tax structuring and tax due diligence advice to corporate and private equity clients and companies in computer hardware, software and Saas, semiconductor, oil and gas, and entertainment.

DAVID P. HERING

DAVID P. HERING

David is a partner in KPMG LLP’s Washington National Tax Mergers and Acquisitions practice and is based in Silicon Valley. He is responsible for reviewing KPMG tax opinions and other advice for technical accuracy and to ensure compliance with applicable professional standards. He specializes in subchapter C and consolidated return issues, including reorganizations, acquisitions, divestitures, liquidating and non-liquidating distributions, and debt restructurings.

TRACI HORWITZ

TRACI HORWITZ

Traci is a Director in PwC’s M&A tax practice in Silicon Valley, CA, where she is focused on corporate tax transactions, including mergers and acquisitions, corporate divisions, cross-border reorganizations, attribute carryovers, liquidations, and redemptions. Traci has advised on numerous transactions providing both tax due diligence and tax structuring advice to private equity clients and companies in the e-business, computer hardware, software, semiconductor, and consumer business industries.

NATALIE JESSOP

NATALIE JESSOP

Natalie has more than 29 years of experience as a CPA providing services to a wide range of companies from venture-backed start-up’s to public multinational corporations. She now focuses exclusively on venture capital industry and is the PwC national leader of venture capital tax practice. She represents over 50 venture capital fund groups, with expertise in the tax aspects of fund formation, terms, ongoing operations, and general partners including multi-state and generational issues. Natalie began her career with the San Jose office of Arthur Andersen where she was a partner working on numerous start-ups and IPO’s. She joined PricewaterhouseCoopers as a partner in 2002. She is a member of the American Institute of Certified Public Accountants, the California Society of CPA’s, and various other professional and civic organizations. She is a regular speaker at conferences and has published several articles on the US tax aspects of financing transactions and how they apply to the VC/PE industry.

ROBERT JOHNSON

ROBERT JOHNSON

Robert Johnson leads Crowe’s state and local tax practice in California. He is a solutions oriented tax professional with more than 20 years of experience. Mr. Johnson has significant experience providing tailored tax services to clients ranging from publicly held Fortune 500 companies to privately held emerging growth firms. He provides state and local tax compliance and consulting services including mergers and acquisition planning, apportionment planning, restructurings, credits and incentives, sales tax, tax audit controversies and tax accounting matters. Prior to joining Crowe, Mr. Johnson worked in Big 4 Firms for more than 20 years and was a leader in national and local practices. He is also an Adjunct Professor at California State University, Northridge.

PAUL T. KANGAIL

PAUL T. KANGAIL

Paul is a tax partner in Ernst & Young’s Financial Services Office – Asset Management Practice and is based in San Francisco. Paul has over 20 years of experience providing tax consulting and compliance services to clients in numerous sectors of the financial services industry. He has extensive experience working with hedge funds, private equity funds, venture capital funds, real estate funds, and mutual funds. Paul works closely with his clients in analyzing entity structuring and the taxation of their investments.

KEN LEE

KEN LEE

Ken is a partner specializing in the State and Local Tax (SALT) practice of PwC. He provides service to some of their largest and most notable clients in Silicon Valley. Ken has extensive experience in core income/franchise tax, sales and use tax and other specialties. Ken also serves as the SALT Business Unit Regional Services Coordinator (RSC) for the West Region. In the RSC role, Ken leads the deployment of SALT services to clients in markets across the Pacific Northwest, California, Rockies and through Texas along with 29-partners and over 400 professional staff. Ken joined PwC in 1998 as an experienced associate in the San Jose office. He has been a featured speaker at Committee on State Taxation (COST), Institute for Professionals in Taxation (IPT), New York University, Tax Executives Institute (TEI) and other tax and business organizations.

JENNIFER MALIN

JENNIFER MALIN

Jennifer is a Senior Tax Consultant in Deloitte Tax LLP’s Los Angeles practice. Prior to starting her career with the firm, Jennifer graduated from the University of Southern California with a Bachelor of Science degree in Business Administration and a minor in Mathematical Finance. Jennifer currently specializes in the identification of tax saving opportunities for companies and assists companies with regulatory, compliance, and industry issues related to accounting methods. Jennifer has worked with companies in a variety of industries including consumer products, biopharmaceutical, technology, hospitality, and retail.

JIM MAROCCO

JIM MAROCCO

Jim Marocco is the Corporate Controller for Google Inc., a $50 billion Fortune 100 information and technology company. He started with Google over ten years ago and during that span he has been responsible for a variety of key financial activities including accounting and controls, compliance, forecasting and analysis, financial and order management systems, strategic deal support and managing outsourced operations. Jim currently manages a global team of 175 people covering over 200 entities in more than 40 countries. Prior to joining Google, he held various financial and management positions at technology companies including the parenting media start-up Dr. Spock Company, Lycos, NEC Technologies and Fujitsu. Jim holds a B.S. degree in Economics from Cal Poly, San Luis Obispo.

LINDSAY MILLER

LINDSAY MILLER

Lindsay is passionate about the people side of accounting and enjoys building relationships with her clients, team and community. She is a Tax Manager with Grant Thornton with over eight years of experience helping corporate tax clients. She has a strong background in accounting for income taxes for both public and private companies, as well as corporate tax compliance and consulting. She serves clients across many industries, focusing heavily on financial services (including mortgage originators, banks, REITs, and funds) as well as technology (including software and med device) and professional services. Outside of the office she serves on the Board of Directors for The Africa Project, a locally based, grass roots nonprofit which strives to make a difference in the lives of children and families in Nkandla, South Africa. She is also a member of the inaugural UC Irvine Young Alumni Council. Although not a CPSLO alumni, Lindsay grew up in San Luis Obispo with close ties to the College of Business.

SADLER NELSON

SADLER NELSON

Sadler is a member of Ernst & Young LLP’s International Tax Services practice for the West Sub-Area. He is based in San Jose, California, and regularly advises clients on a wide variety of international tax matters. Sadler has extensive experience in the development and implementation of cross-border restructurings. Sadler began his career in the technology, communication and entertainment industry group of Ernst & Young LLP’s National Tax Department in Washington, D.C.

MATT NORMINGTON

MATT NORMINGTON

Matt Normington, San Jose, California, is a senior manager with the Research & Development and Government Incentives Group and has 12 years of experience as a research and development tax credit specialist in the Silicon Valley. Matt has significant experience managing complex R&D tax credit projects for clients of various sizes, with emphasis on high-technology and software industries. Matt has experience with all aspects of the R&D tax credit, including: risk analysis, complex quantitative calculations for controlled groups and third-party funding arrangements. In addition, Matt has deep experience defending the R&D tax credit during examinations by the IRS and/or state taxing authorities.

JOSEPH ORLANDO

JOSEPH ORLANDO

Joe Orlando is a Director at Frank, Rimerman + Co. LLP and leads the Business Valuation Services practice. In addition to managing the practice, Joe focuses on fundamental valuation for tax and financial reporting purposes as well as litigation and family law. He has over 20 years of professional experience as a fundamental valuation expert, investment banker and financial analyst.

CHUCK PACKER

CHUCK PACKER

Chuck Packer is a Shareholder (Partner) with Hopkins & Carley, A Law Corporation, located in the Silicon Valley. Chuck is Co-chair of the Firm’s Family Wealth & Tax Planning Practice and also serves as a member of the Firm’s Executive Committee. Chuck obtained his JD/MBA from Santa Clara University in 1980 and started his professional career in the tax practice at Cooper & Lybrand (the predecessor to PwC). Chuck has practiced in the area of trusts & estates law since 1986. He provides strategic planning counsel on estate, gift and philanthropic tax planning with a primary focus on issues concerning estate planning, sophisticated wealth transfer planning and family business. Chuck is the Chair of Santa Clara University’s School of Law Jerry A. Kasner Estate Planning Symposium, a nationally recognized multi-day continuing education program, now in its 12th year. Chuck and his wife Joan have two children, a son who is a Senior at UCSB with a double major in economics and accounting, and a daughter who is a Sophomore at Cal Poly’s Orfalea College of Business, also majoring in accounting. When not working, Chuck enjoys travel with his family and is an avid cyclist and volunteer coach for the Leukemia & Lymphoma Society’s Team in Training cycle team.

ERIC PETERSON

ERIC PETERSON

Eric Peterson, San Jose, California, is a partner and the West Coast leader of Deloitte Tax’s national Research & Development and Government Incentives Group. Eric has 32 years of professional experience, including 23 years as a research credit specialist. Eric has in-depth experience assisting large and small corporations in increasing R&D tax credits. As the leader of our Silicon Valley R&D practice, Eric has worked with many semi-conductor, software, and high-technology companies. He is a frequent speaker at the Tax Executives Institute, at both the local and national level. He has also worked extensively with the Internal Revenue Service and California Franchise Tax Board at both the Examination and Appeals levels to successfully resolve issues associated with research tax incentive claims.

SHIRISH RAJURKAR

SHIRISH RAJURKAR

Shirish is a Managing Director in KPMG’s International Tax Practice, of which he has been a member for 19 years, and is based in the firm’s Silicon Valley office. He has extensive international experience with international structuring, intangible planning, transfer pricing issues, withholding taxes, foreign tax credit planning, domestic production deduction and international market entry/expansion. Shirish advises large multinational companies in a variety of industries including the software, semiconductor, financial services, manufacturing, and services sectors.

BRIAN D. ROSE

BRIAN D. ROSE

Brian is a Tax Partner in the Los Angeles office of Deloitte Tax LLP within the firm’s national Strategic Tax Review practice. For the past dozen years, Brian has worked with over 300 companies assisting with various federal tax accounting method, revenue recognition and fixed asset opportunities. Brian is also a national leader in Deloitte’s fixed asset practice, which specializes in analyzing a client’s capitalization and depreciation policies and procedures to identify significant recurring tax saving opportunities and assisting them with regulatory and compliance issues related to fixed assets.

NEIL ROSENBERG

NEIL ROSENBERG

Neil is a Private Equity, Venture Capital and Real Estate Tax Partner based in PwC’s San Francisco office and serves as the NorCal Tax Leader for these practices. Neil has over 28 years of experience servicing the tax needs of funds and their GPs. He has broad experience in providing advice on a variety of issues including structuring, investor issues, unrelated business taxable income, allocations and succession issues. Neil represents several major funds and has advised them on multitude of transactions from GP ownership, fund formation, portfolio transactions, distributions and liquidations. Neil specializes in Partnership Tax, REITs, Investment partnership and related transactions.

EDWARD SCHULTE

EDWARD SCHULTE

Edward is a partner with KPMG’s Bay Area hedge fund team. He has more than 15 years of experience in public accounting and focuses on the alternative investment industry. He specializes in the taxation of hedge funds. Edward was previously a Principal with Rothstein Kass. He began his career at KPMG in Minneapolis and was a tax manager in the alternatives investment practice.

SAMUEL M. SEAMAN

SAMUEL M. SEAMAN

Sam is a tax partner and a member of the Asset Management Practice in BDO’s San Francisco office. Sam has over 16 years of experience serving alternative investment funds including hedge, private equity and venture as well as RIAs. He currently consults his clients on a variety of tax-related structuring and compliance related issues including transaction tax implications, foreign tax matters, management company consultation related to changes in ownership and individual tax planning and optimization strategies. Prior to joining BDO, Sam co-founded Strata Fund Solutions, a fund administrator serving hedge, venture and private equity fund complexes.

SHAIL SHAH

SHAIL SHAH

Shail Shah is a Managing Director in Andersen Tax’s State and Local Tax practice in San Francisco. Shail has more than 10 years of experience in state and local tax matters, with a focus on California income tax matters and state tax controversy. Prior to joining Andersen Tax Shail was Tax Counsel at the Franchise Tax Board and worked in Ernst & Young’s state and local transaction tax practice.

MARTIN J. SKRIP

MARTIN J. SKRIP

Marty currently is the Tax Leader for the Northern California Commercial Practice at Crowe Horwath LLP. He has over 25 years of corporate tax consulting experience servicing Bay Area clients from Fortune 500 multi-national companies to privately held emerging companies. Prior to joining Crowe , Marty was a senior corporate Tax Partner at KPMG LLP, in the San Francisco office, where in addition to his client responsibilities was also the Risk Management –Tax Partner for the West Area. Marty is a member of the Dean’s Advisory Council at the Orfalea College of Business at Cal Poly.

JEFF SOKOL

JEFF SOKOL

Jeff has nearly 18 years of public accounting experience with Deloitte working primarily with high technology and manufacturing clients. Jeff has practiced in Deloitte’s San Jose office since 2001. Jeff primarily serves large, multinational, publicly-traded companies but also works closely with venture-funded start-ups. Before working out of the Deloitte San Jose office, Jeff worked in Deloitte’s National Tax Office in Washington, D.C. where he was a member of the Subchapter C group, specializing in mergers and acquisition-related tax issues.

ADAM STEINMETZ

ADAM STEINMETZ

Adam is a West Region Tax Accounting & Risk Advisory Services team member in Grant Thornton’s San Diego office. Throughout his 11-year career in public accounting, which includes two years at Grant Thornton’s Washington National Tax Office, Adam has consulted on a wide variety of corporate tax matters. Adam specializes in corporate consulting, audit support over ASC 740, federal income tax provisions, mergers and acquisitions support, and tax structuring. Adam has worked with a variety of enterprises including closely held businesses, emerging growth companies, pre-IPO companies, complex private companies, and large public companies.

ROBERT TERPENING

ROBERT TERPENING

Rob is a Partner in Ernst & Young’s Tax practice with more than 20 years of experience serving the tax planning, financial reporting, tax compliance and risk management needs of technology and life science companies in all phases of growth, from VC backed startups to billion dollar multinationals. In addition to his client serving responsibilities, Rob leads our West Tax Accounting and Risk Advisory Services practice.

JAMES G. TOD

JAMES G. TOD

Jim is a Partner in the Passthroughs Group for KPMG’s Washington National Tax Practice. The Passthroughs Group is responsible for providing advice to KPMG professionals and clients regarding the federal taxation of partnerships, real estate investment trusts and S corporations across all major industries. In addition, the Passthroughs Group advises on specialty areas such as like-kind exchanges, oil and gas, leasing, and excise taxes.

MATTHEW J. WATSON

MATTHEW J. WATSON

Matt graduated with a Bachelor of Science in Accountancy and a Master’s Degree in Taxation from Brigham Young University, Utah. He worked for PriceWaterhouseCoopers before returning to California’s Central Coast. Matt specializes in tax planning and preparation for business entities and related individuals, including real estate transactional taxation and planning. He is a member of the American Institute of CPAs and the California Society of CPAs.

PRENTISS WILLSON

PRENTISS WILLSON

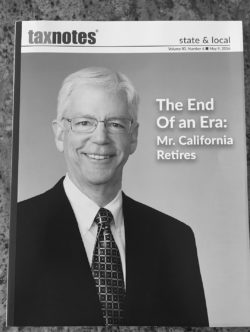

Mr. Willson received his A.B. degree from Occidental College in 1965, and his J.D. degree from Harvard Law School in 1968. After 28 years at Morrison & Foerster where he was Managing Partner of the San Francisco office, co‐chair of the firm’s Tax Department, as well as head of the firm’s State and Local Practice group, he moved to Ernst & Young in 1998 as a Partner and as National Director of State and Local Tax Practice and Procedure. In 2002 he retired from Ernst & Young but continued his own practice advising clients across the country. Mr. Willson, noted as one of the most prominent practitioners in his field, has appeared as a frequent panelist at continuing education programs throughout the country. He has also taught at Stanford Law School, University of San Francisco Law School and at the Golden Gate University Graduate School of Taxation. In 2008 he was named as a co‐reporter to the project of the National Conference of Commissioners on Uniform State Laws (NCCUSL) to rewrite UDITPA, the act most states have adopted for apportioning the income of multi‐state taxpayers.

MIKE YATES

MIKE YATES

Mike is a partner in the firm’s Tax Practice, working primarily out of our San Jose office. He specializes in providing tax consulting services to companies in transition including initial financing, international expansion and exit strategies. He is experienced in advising business owners on the most advantageous tax strategies for a merger, acquisition or sale of a business. Mike also has extensive experience in advising entrepreneurs and other high net worth individuals in the areas of tax planning, asset protection planning, estate planning, stock option strategies, risk management, and investment analysis. He is the trusted advisor and CFO for a small number of high net-worth clients. He is highly effective at building his clients’ wealth by minimizing or eliminating income, gift, and estate taxes. Mike has over 30 years of experience in providing tax and financial planning services to companies, entrepreneurs, executives, employees, and tax exempt entities.